Why is Customer Lifetime Value the optimization metric in eCommerce?

Why is Customer Lifetime Value the optimization metric in eCommerce?

In a word, it empowers online retailers (and marketers for that matter) to focus their efforts and money toward the most valuable customers, resulting in better ROI.

Companies should shift their money to the people and not to media anymore.”, Greg Head, CMO at Infusionsoft.

- The most valuable customers are the most profitable ones – that buy more, purchase more often and that are inclined to be loyal and refer the brand. 20% of the customers generate 80% of the revenue (Pareto’s principle).

- Based on the CLV data online stores can build truly customer-centric companies, talking one-to-one to each prospect and current buyer.

- The CLV calculation and analysis embodies data flows from different teams to give an insight of how to canalize all efforts for better ROI. Then it spreads back to every team that incorporates it in the marketing strategies, value proposition, product mix, CS and customer satisfaction strategies, etc.

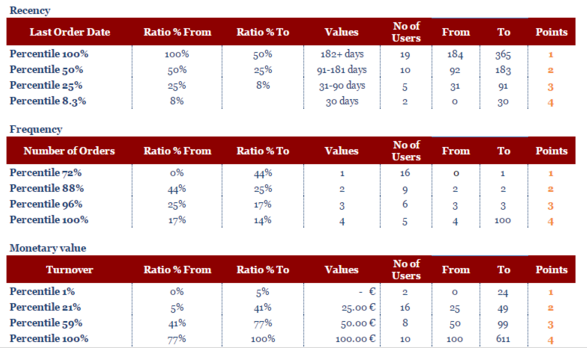

- You can segment your customer base smartly – by individual behavior and by the value a customer brings for the business. Consider implementing the RFM model for example. It takes into consideration when was the last time a customer has purchased anything, how many times he has purchased over a timeframe. Also, how much is the amount of money a customer has spent in your shop within a timeframe.

SEE ALSO: A step-by-step guide to set up the RFM model.

How to Calculate the Customer Lifetime Value?

There are many formulas out there that give a general insight on the CLV state or include more complicated calculations. See some of them listed in this Smart Insight post.

It is advisable to start with a simple formula to evaluate what is your state and future growth potential as well.

CLV = CV x T = AOV x F x T

You can use that formula and calculate in a spreadsheet xls calculator, available here.

Other than that, keep in mind that:

- Average Order Value (AOV) = Total Revenue / Total Number of Orders

- Purchase Frequency (F) (per customer, per year) = Total Orders per Customer / Unique Customers

- AOV and PF give you the customer value of your average customer in the measured period of time – the Customer Value (CV).

- Customer Lifetime (T) = time (years) before a customer churns. Usually, this is a period of two to three standard deviations of the average time between purchases.

Except this xls calculator, you can also use online tools like RJMetrics, Avaya, Harvard.

How to Higher Your Profits Thanks to CLV

Let’s see, after knowing your numbers, how to optimize them and manage the CLV drivers in the best way.

#1. Personalize your website interaction.

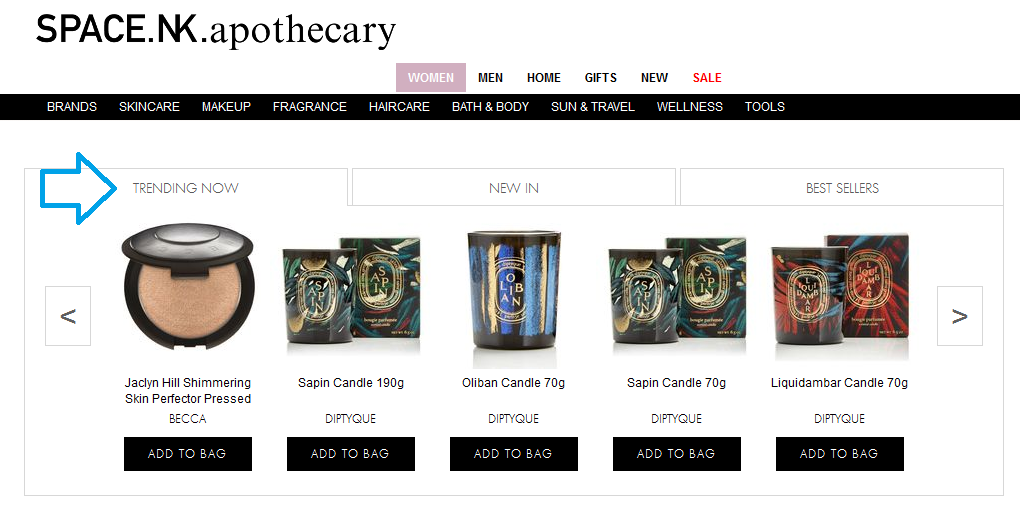

- Include product recommendation widget at homepage (displaying trending items) as to inspire your website visitor to keep browsing.

- Display personalized product or category lists. Customers prefer reviewing only relevant item recommendations.

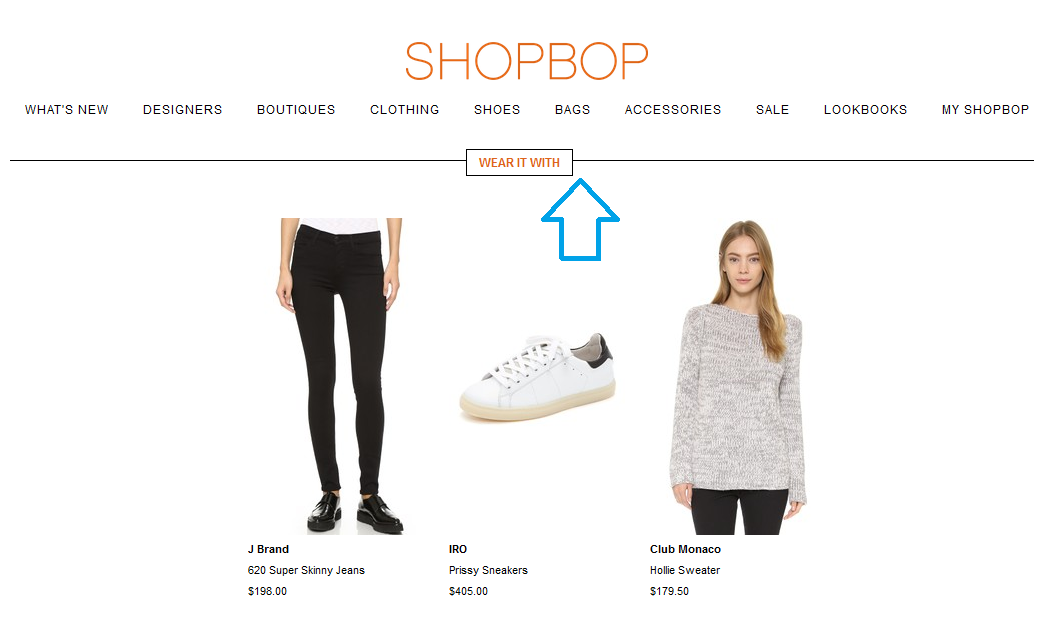

- At product page, trigger up- and cross-sell through including “Similar” and “Complementary” item suggestions, based on previous customer behavior or previous history with your brand. Read how it works

- Lower your cart abandonment rates with adding complementary products box. Wouldn’t it be nice that while shopping a nice red pair of stiletto shoes you are also offered a nice red evening clutch to create a complete outfit?

- Include personalized pop-up and banner messages. Imagine if you can use 10% off in case you add this evening clutch to your cart. Set up such a pop-up to be triggered if the customer tries leaving the cart page without finalizing their order.

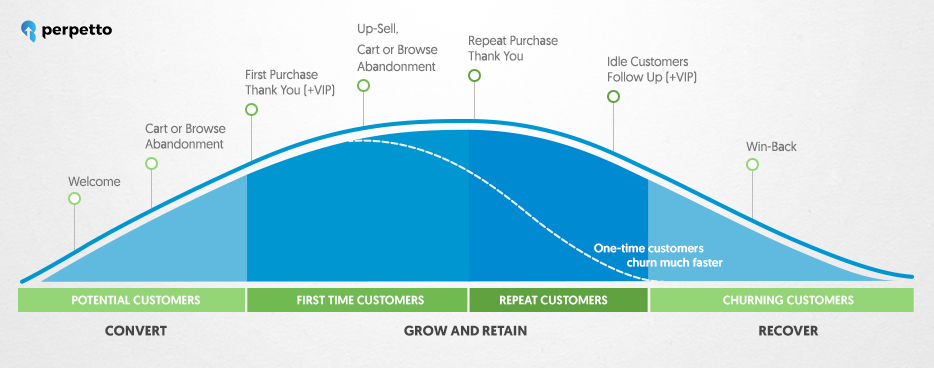

#2. Create a one-to-one, yet automated, communication flow with your customers.

- When having potential customers (having placed no orders yet), send out welcome emails, preferably including first-time-buyer discount. Also, message your prospects through email in case they abandon any product page or cart abandonment page. Remind them of items they’ve already viewed and offer complementary ones.

- After their first purchase, celebrate the event with a thank-you email. Again, be present in case of browse abandonment behavior. Test what works best for you: one-time triggered email or sequence of a few (including reminders and discounts). In a recent survey Soundest discovered that The Cart Recovery Series of three emails for example results in 131% more orders than a single email (see infographic).

- Keep repeat buyers engaged and re-activate customers that haven’t purchased from you for some time. Create interest-based email campaigns, including discount too. For example, email your VIP spenders that haven’t purchased anything for 3 months with personalized item suggestion of their favorite brand on 30 off and time limit of 24 hours.

The great thing is that email automation makes it possible for the customers to automatically shift within the segments and you can scale, yet “talk” one-to-one. That is important as customers are as demanding as they’ve never been and personalization in no longer an extra but an expectation.

SEE ALSO: free 7-day crash course: Introduction to Email marketing automation.

#3. Keep customers coming back.

Repeat customers spend 67% more than a new customer (Bain & Co.)

- Use dynamic remarketing campaigns. They display items (ones that your website visitor has already views and / or similar product) on other websites, after they have left your shop. Here are more guidelines and also set-up steps.

- Create loyalty programs to keep your customers engaged with your brand. Here is some inspiration from Nordstrom, Gilt, Bebe and more.

- Subscription models can serve the same goal too with also adding another revenue stream. See how Birchbox and Amazon do it.

Conclusion

With creating multiple and personalized touch points with your potential and current customers you influence directly your revenue, AOV, retention rates etc. For that matter, uplift the CLV too.

SEE ALSO: How to start with and then manage CLV and its drivers for Magento shops – a step-by-step guide.

Yet, there are only about 5% of online businesses that actually measure and use CLV. Let’s share the news!