Do you believe all shipping carriers are equal? Think again! A recent Stamps.com study shows that the USPS has an edge on the competition — and knowing how to leverage these results may help you lower costs and improve your package delivery times.

Do you believe all shipping carriers are equal? Think again! A recent Stamps.com study shows that the USPS has an edge on the competition — and knowing how to leverage these results may help you lower costs and improve your package delivery times.

About the Study

In September 2013 and January 2014, Stamps.com conducted a study to evaluate the three largest shipping carriers in the U.S. – the U.S. Postal Service (USPS), UPS and FedEx. The study was designed around the top factors e-commerce business owners consider in their shipping decisions: reliability, delivery time and cost.

Methodology

Stamps.com staff in Los Angeles, Virginia and Chicago shipped 144 packages to locations across all eight shipping zones for domestic delivery. The three origination cities represented West Coast, East Coast and Central U.S. locations, respectively and were chosen to represent common warehouse locations in the U.S. All packages were shipped using price comparable services of each carrier – FedEx Home Delivery, UPS Ground and USPS Priority Mail.

Monday and Thursday were the chosen shipping days for all locations in order for the study to examine business-week and weekend delivery patterns. Also, all packages were identical in size and shape – a 1 pound, 9 ounce brown box measuring 12”x9”x3” – to represent a typical shipment for a broad range of e-commerce businesses. For each package, Stamps.com staff monitored the number of tracking events (scans) during transit, delivery time and overall cost.

The Findings

While all three carriers successfully delivered 100 percent of the study’s packages undamaged and without losing them in transit, and tracking scans were nearly equal among the carriers, the study determined that USPS had a leg up on the competition in both delivery time and cost. All USPS Priority Mail packages shipped on Mondays arrived at their destination within two days, compared with UPS Ground (50%) and FedEx (58%). USPS also led the pack in two-day deliveries over longer distances.

The study found U.S. Priority Mail to be the lowest-cost option for packages 2 pounds or lighter, with savings of up to $4.46 per package compared to the next lowest-priced carrier, and also offered similar savings for packages weighing between 3 and 7 pounds.

What Does This Mean for You in Terms of Cost?

As an e-commerce owner, you probably are aware that high shipping costs are the number one cause of shopping-cart abandonment. As a result, more sellers like you are finding they have to lower shipping costs in order to stay profitable and competitive.

So how does USPS come out ahead? UPS and FedEx incorporate a number of fees in their costs, including surcharges for fuel, residential delivery and rural locations (also known as a Delivery Area Surcharge). To calculate shipping costs for the study, “earned discounts” of 15% were added and a $2.80 residential surcharge and fuel surcharge for FedEx and UPS were incorporated. For the USPS shipping costs, Commercial Base (online postage discounts) rates were used. The USPS is the only carrier that does not include any surcharges in its shipping costs.

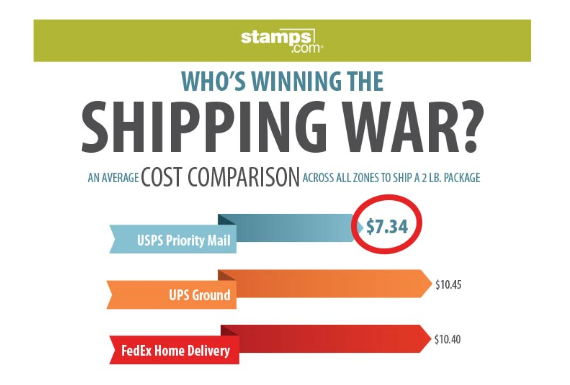

The study showed that the average cost to ship a 2 lb. package across all zones is $7.34 for USPS Priority Mail, $10.45 for UPS Ground and $10.40 for FedEx Home Delivery.

The total cost (with surcharges) to ship a 2 lb. package to a residence ranges between $9.78 and $11.19 across all zones for UPS and between $9.73 and $11.14 for FedEx. In comparison, USPS’s prices ranged between $5.32 and $9.97 to ship that same 2 lb. package across all zones, resulting in average cost savings of $3.11.

The Bottom Line

Today, buyers have come to expect shipping to be both prompt and price-effective. That’s why it’s more important than ever for you to carefully consider your e-commerce business’ shipping program. Choosing the right carrier can help keep your prices low, and your profit margins high.

For more about the methodology of the study and its findings, download the Who’s Winning the Shipping War? white paper.